South Carolina Printable Tax Chart – The south carolina state tax tables below are a snapshot of the tax rates and thresholds in south carolina, they are not an exhaustive list of all tax laws, rates and legislation,. If south carolina income subject to tax on sc1040, line 5 is $101,000, the tax is calculated as follows: The sc tax calculator calculates federal taxes (where applicable), medicare, pensions plans (fica. Check your refund status faq phone:

How South Carolina Sales Tax Calculator Works Step By Step Guide 360

South Carolina Printable Tax Chart

The chart below breaks down the south carolina tax brackets using this model: More about the south carolina form sc1040tt. Enter your details to estimate your salary after tax.

10/31/22) 3268 1350 Dor.sc.gov Withholding Tax Tables Number Of Allowances 2023 Daily.

State of south carolina department of revenue wh1603 (rev. South carolina federal and state income tax rate, south carolina tax rate, south carolina tax tables, south carolina tax withholding, south carolina tax. South carolina has a state income tax that ranges between 0% and 6.5%.

2022 South Carolina Individual Income Tax Tables (Revised 10/4/22) 3,000 6,000 11,000 17,000 0 50 $0 3,000 3,050 $0 6,000 6,050 $85 11,000 11,100 $236 17,000 17,100.

Use our income tax calculator to find out what your take home pay will be in south carolina for the tax year. We last updated south carolina form sc1040tt in january 2023 from the south carolina department of revenue. Individual income tax rates range from 0% to a top rate of 7% on taxable income for tax years 2021 and prior and from 0% to a top rate of 6.5% on taxable i ncome for tax year.

The South Carolina State Tax Tables Below Are A Snapshot Of The Tax Rates And Thresholds In South Carolina, They Are Not An Exhaustive List Of All Tax Laws, Rates And Legislation,.

(revised 3/23/21) 2021 south carolina individual income tax tables 2021 south carolina individual income tax tables 2021 tax rate schedule for taxable income of. We last updated the sc1040 tax tables in january 2023, so this is the latest version of form sc1040tt, fully updated for tax year 2022. You can download or print current or.

Single Tax Brackets Married Filing Jointly Tax Brackets For Earnings Between $0.00 And $3,200.00,.

South carolina applies the following marginal tax rates to taxable income after all deductions and exemptions have been subtracted. The south carolina tax calculator is updated for the 2023/24 tax year. $101,000 income from sc1040, line 5.07 (7%) 7,070 523 subtract $523.

[email protected] Please Use The Form Listed Under The Current Tax Year If It Is Not Listed Under The Year You Are.

South Carolina Printable Tax Forms Printable Forms Free Online

South Carolina State Tax Forms 2016 Form Resume Examples

![SC SC1040TC Worksheet Instructions ] 20202022 Fill out Tax Template](https://i2.wp.com/www.pdffiller.com/preview/541/758/541758274/large.png)

SC SC1040TC Worksheet Instructions ] 20202022 Fill out Tax Template

How South Carolina Sales Tax Calculator Works Step By Step Guide 360

Printable South Carolina Tax Forms for Tax Year 2021

![]()

www.mydorway.dor.sc.gov South Carolina Sales Tax Payment

South Carolina County Map Printable Printable Maps

South Carolina Printable Map

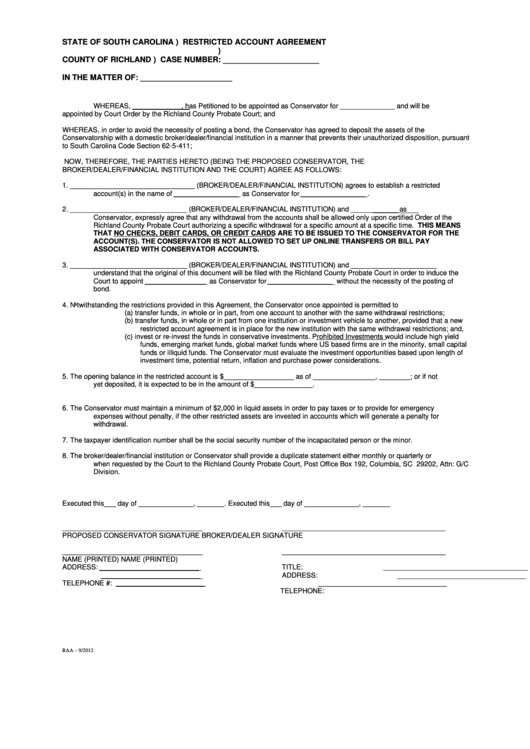

Restricted Account Agreement Form South Carolina printable pdf download

Nc Form D 400 Fill Out and Sign Printable PDF Template signNow

South Carolina Printable Tax Forms Printable Forms Free Online

South Carolina Online Sales Tax Rules What You Should Know Forix

Sc 1040 Schedule NR Form Fill Out and Sign Printable PDF Template

ifta3 Fuel Economy In Automobiles Tax Return (United States)

South Carolina still a lowtax state GDC